The National Federation of Independent Business’s Small Business Optimism Index rose to 91.0 in June from 89.4 in May, matching Comerica’s forecast and above the 89.9 consensus forecast.

The recovery follows Washington reaching a deal on the debt ceiling and mirrors the index’s rebound after the prior debt ceiling standoff was resolved in 2011. The forward-looking Outlook sub-index rose sharply to the highest since February 2022, while the share of businesses raising prices was the lowest since March 2021. That is an improvement, but price hikes are still as widespread as in July 2008, when the CPI surged to 5.6%.

The balance of opinion on expected real sales turned less pessimistic, too, rising to the least-bad since February, but on balance has been trending lower since 2018. From a broader perspective, the pandemic and its aftermath have been incredibly difficult for small businesses, pressuring margins since small businesses have less ability to pass on price increases than larger ones.

The tight labor market is making it much more difficult for employers to fill positions, too. ADP reports small business employment is down 262,000 since January, while overall employment rose 1,458,000. In a tight labor market, larger employers are crowding out labor demand from small businesses.

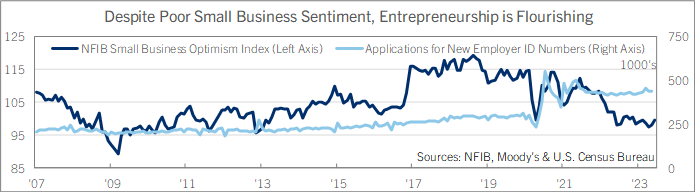

The silver lining is that entrepreneurship is booming. The share of owners in the NFIB’s survey sample saying it is a good time to expand business rose in June but was still about as depressed as in mid-2009, when the economy was on its back in the depths of the Great Recession.

But the number of applications filed to start new businesses—a concrete measure of new businesses, founded by new owners who are less likely to be in the NFIB survey sample—was higher in June than any month between mid-2004 and the end of 2019. For the Fed, the pullback in price increases in the NFIB survey is more evidence that inflation is moving in the right direction, but not enough to stop them from raising their benchmark rate again at their decision later this month.

The NFIB’s survey panel is much more concerned about inflation than normal, as are respondents to other surveys of businesses and consumers conducted by private research organizations and the Fed itself. The Fed will keep monetary policy tight until inflation slows, and attitudes towards it return to their pre-pandemic norms.

Bill Adams is a senior vice president and chief economist at Comerica. Waran Bhahirethan is a vice president and senior economist at Comerica.