Inflation slowed less than expected in January, with big increases in sticky service prices like car insurance, restaurant prices, hospital services, and other labor-intensive services.

Consumers are seeing a lot of relief from inflation among price categories that change rapidly, like gasoline and used cars. They are seeing less relief for services whose prices change slowly, and in fact inflation in these categories continues to run fairly hot.

The CPI rose 0.3% in January, a little above the 0.2% consensus forecast. Food prices rose 0.4%, with food at home up 0.4% and labor-intensive food away from home up 0.5%. Energy prices fell 0.9% on a 3.3% decline in gasoline prices.

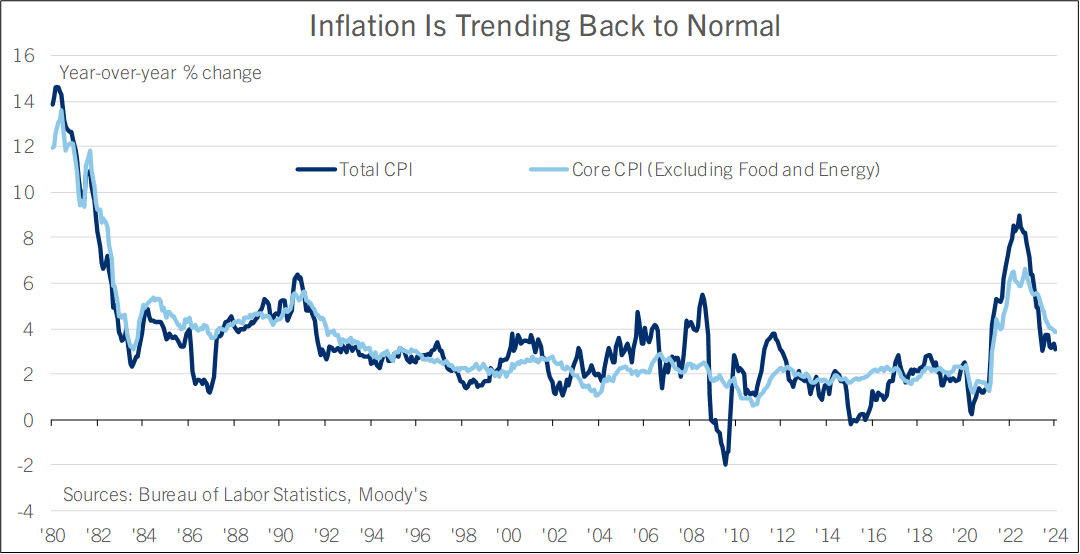

The core CPI excluding food and energy rose 0.4%, above the 0.3% consensus forecast. From a year earlier, the CPI rose 3.1%, down from 3.4% and tying November. CPI is down from a peak of 9.1% in June 2022. Core CPI was unchanged at 3.9%, the lowest since May 2021. It peaked at 6.6% in September 2022.

Within the core basket, used cars and trucks fell 3.4% and new vehicle prices were unchanged. Shelter costs rose 0.6% (including a 1.8% increase in lodging away from home, which includes hotels and motels), while transportation services increased by 1.0%. Motor vehicle insurance rose 1.4%. Medical care services rose 0.7% on a 1.6% increase in hospital service charges.

Core service prices less energy and shelter rose 0.7%. Core services less housing rose 0.9%. These two sub-indexes are good trackers of “sticky” service prices, which tend to be labor intensive and to change more slowly than gas prices or used car prices.

The Fed is monitoring these slices of the CPI to look through the impact of supply chain disruptions on inflation and tease out the underlying trend. From a year earlier, both of these measures of core inflation were the highest since May 2023: CPI Core Services excluding Energy and Shelter picked up to 4.4% from 4.1%, while CPI Core Services Excluding Energy and Housing rose to 4.3% from 3.9%.

In short, the supply chain problems that drove inflation in 2021 and 2022 are unwinding, fueling relief in inflation of goods prices—but not helping inflation of sticky service prices.

Specifically, the pickup of core service price inflation in January likely reflects businesses that adjusted pricing after the turn of the year to pass on higher operating costs realized in 2023. Respondents to the ISM Purchasing Managers Index survey of nonmanufacturing businesses reported a much broader-based increase in prices in January than in December, suggesting that the repricing effect in the CPI report is signal and not noise.

January’s CPI report was disappointing relative to expectations before its release, which anticipated more of a slowdown. The path to lower inflation isn’t a straight line. But even so, the CPI’s overall direction of travel is unmistakably lower.

The last few months have seen big improvements in privately-conducted surveys of consumer confidence by The Conference Board, the University of Michigan, and the New York Fed that reflect a broadening awareness that prices are putting less pressure on household finances. Households are cheered to see a return of discounting and deals at retailers, and expect that to spread in coming months to other prices they pay.

Similarly, the share of small business owners who report inflation is their single largest problem retreated in January to the least since late 2021, according to the National Federation of Independent Business’s monthly survey. Small business owners were livid about inflation in 2022 and 2023—if even they are feeling less dissatisfied, something must be going right.

The CPI report will reinforce the Fed’s inclination to take their time as they lower interest rates this year. They want to see the momentum that built up in inflation over the last few years peter out more definitively before they take their foot off the brake. Comerica forecasts for the Fed to hold rates steady at their next two decisions, then make a first quarter percentage point rate cut at their June decision, with subsequent cuts in September and December. The Fed is also likely to slow the pace at which they reduce the size of their balance sheet in the second half of 2024, and likely end balance sheet reductions (a.k.a. Quantitative Tightening or QT) in late 2024 or early 2025.

Bill Adams is a senior vice president and chief economist at Comerica. Waran Bhahirethan is a vice president and senior economist at Comerica.