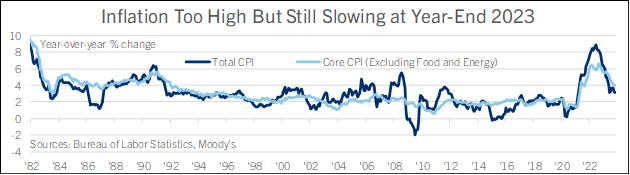

The consumer price index rose 0.1% in November, slightly above the consensus forecast for zero inflation. From a year earlier, the CPI matched the consensus forecast to slow to 3.1% after 3.2% in October, and was near June 2023’s 3.0% increase, which was the slowest since early 2021. CPI hit a multi-decade high of 9.1% in June 2022 as a combination of an overheated domestic economy and energy and food price shocks due to the Ukraine-Russia war hit American pocketbooks. While inflation is down sharply since then, it is still above the Fed’s target. The Fed targets 2% inflation by the personal consumption expenditures price deflator, which averages about a quarter percentage point less than CPI over time.

Food prices rose 0.2% in November, with food at home up 0.1% and food away from home up 0.4%. From a year earlier, food at home is up 1.7%, while food away from home is up 5.3%. Energy prices fell for a second consecutive month, down 2.3% on a 6.0% drop in gasoline and a 2.7% drop in fuel oil, offset by a 1.4% increase in electricity and 2.8% increase in piped gas. From a year earlier, energy prices fell 5.4% in November.

The core CPI index excluding food and energy rose 0.3% in November, matching the 0.3% consensus and following a 0.2% increase in October. From a year earlier, core CPI matched October’s 4.0% increase, the slowest since late 2021, and is down from a multidecade high of 6.6% in September 2022. New vehicle prices fell 0.1% as dealers and carmakers priced aggressively to win market share, with competition for EV sales especially fierce after many new models launched earlier this year. From a year earlier, new vehicle prices rose 1.3%. Used car and truck prices rose 1.6% after declines in the five prior months. They were down 3.8% on the year. Transportation services rose 1.1% on the month, with motor vehicle insurance up 1.0% on the month and public transportation up 1.0%. Airfares fell 0.4% and car and truck rentals fell 2.2%. Shelter prices rose 0.4% on the month, with rent of primary residence and owners’ equivalent rent (how the CPI measures house prices) both up 0.5%. From a year earlier, shelter inflation slowed to 6.5% from 6.7% in October and a peak of 8.2% in March, which was the highest since 1982.

Inflation looks likely to slow further in 2024. Gas prices at the pump are down $0.75 a gallon from their September peak, and also down in year-over-year terms, as U.S. domestic oil production holds near a record high, boosting inventories. The renewables boom is helping hold down energy prices, too: Renewables supplied two-fifths of 2023’s net increase in U.S. energy consumption, according to the EIA’s December Short-Term Energy Outlook. The Russia-Ukraine and Israel-Hamas wars pose upside risk to energy prices, but so far that risk hasn’t been realized. Core inflation is running a notch hotter than total inflation but it too looks likely to slow in 2024. A boom of new multifamily construction that started in 2021 and 2022 is bringing more rental supply to market, slowing rent increases, and high mortgage rates are slowing the increase of single-family house prices. Inflation pressures from new and used cars are down considerably, and prices of many other categories of durable goods are falling in year-over-year terms—computers, phones, appliances—further slowing core CPI. The upside risk to inflation is from labor-intensive services, which are captured in the “supercore” CPI Index of Services Excluding Energy and Housing. This accelerated to 0.4% in November from 0.2% in October and picked up to a 3.9% year-ago increase from 3.8%, which was the lowest since late 2021. Labor-intensive service prices like a haircut, which like supercore CPI rose 3.9% on the year in November, are how inflation builds up momentum, and could make it hard for the Fed to close the last mile between November’s CPI increase and their target. Considering these cross-winds, Comerica forecasts for CPI inflation to slow to 2.5% in 2024 from 4.1% in 2023.

The biggest sore points for consumers in November were food and shelter prices. Food prices are at an all-time high, with big increases this year for beef, processed foods, and restaurant menu items, reflecting higher costs of animal feed, unprocessed food, and labor in 2022 and early 2023. The shelter CPI is slowing, but that is an average for all Americans—including both the lucky people who bought homes years ago when prices and mortgage rates were much lower, as well as households looking to buy a house now in the least affordable market in decades, after accounting for mortgage rates, prices, and disposable income. More generally, surveys show that people care more about the level of prices—very high!—than the CPI rate, which was only a percentage point above the pre-pandemic normal in November. The share of small businesses who say inflation is still their single largest problem is down from its peak in 2022 but still above any time between 1982 and 2020.

The Fed will welcome slower CPI inflation at the end of 2023 but not see room for interest rate cuts yet. After badly missing their 2% inflation target in 2021 and 2022, the Fed wants to be sure inflation pressures are coming under control before cutting. Comerica forecasts for the Fed to hold the federal funds target unchanged at the current level of 5.25% to 5.50% through mid-2024, and only begin to reduce the rate with a quarter percentage point cut in June. Comerica forecasts a cumulative 0.75 percentage points in federal funds rate cuts next year. That is a little less than is currently priced into financial markets, which have gone from pricing in a higher-for-longer trajectory for interest rates a few months ago, to enthusiasm about a lower-and-sooner path for interest rates in November and December as gas and oil prices fell and job growth moderated.

Bill Adams is a senior vice president and chief economist at Comerica. Waran Bhahirethan is a vice president and senior economist at Comerica.