Matching the consensus forecast, the consumer price index (CPI) rose 0.2% on the month in July, the same pace as June. Food prices rose 0.2%, and energy prices rose 0.1% with a 0.2% increase in gasoline prices offset by a 0.1% decline in electricity. Core CPI excluding food and energy also rose 0.2% and matched the consensus. New vehicle prices edged down 0.1%, used vehicle prices fell 1.3%, while medical care commodity prices rose 0.5%. Shelter costs rose 0.4% and transportation services rose 0.3%, but medical care services fell 0.4%. Airfares fell a seasonally-adjusted 8.1%. Prices of “super-core services” excluding energy services and shelter rose 0.2% on the month after a 0.1% increase in June.

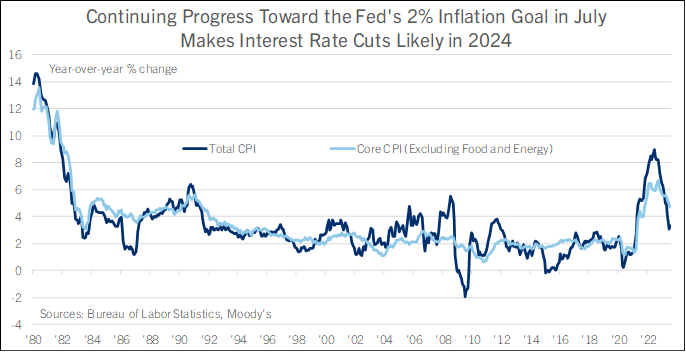

Inflation surged to almost 10% in mid-2022 as an overheated domestic economy collided with global food and energy price shocks after Russia invaded Ukraine. Inflation has slowed sharply since then, with a big improvement in the spring and summer months. Wonky base comparisons made the CPI rise in July; gas prices surged in June of 2022 and then fell the next month, so the uptick in the year-over-year rate of increase is basically noise.

In three-month annualized terms, CPI slowed to 1.9% in July from 2.7% in June and was the lowest since June 2020. In those terms, core CPI slowed to 3.1% in July from 4.1% in June and was the lowest since September 2021. “Super-core CPI” prices of services excluding energy services and shelter rose 1.9% in those terms in July after 2.1% in June and was the lowest since October 2021.

Consumers are seeing broad-based relief on price increases as the economy operates in lower gear and a small margin of slack opens in the labor market. It was somewhat surprising to see gasoline prices up just 0.2% in the July report, with AAA reporting a big increase in the national average price in the latter half of the month. Gasoline will drive higher CPI inflation in August, but pass-through to core inflation will likely be minimal.

The one part of the economy still showing persistent price pressure is wages, with average hourly earnings running close to 4.5% in year-over-year terms since March and exceeding the pre-pandemic normal of 3.0%. Unions have secured some eye-catching wage increases in recent contract negotiations; these affect only a minority of workers directly but could pressure other employers to raise wages to stay competitive. In the base case, wage growth looks on course to slow in the next year as hiring cools in the private sector, workers see fewer opportunities to secure higher pay by switching jobs, and lower inflation eases demands for cost-of-living adjustments. But wages are the part of the economy where it is easiest to imagine inflation pressures surprising to the upside.

The Fed will welcome another month of slower monthly price increases in July and is likely to hold interest rates steady at the next meeting in September. They are still concerned that the strong job market could revive price pressures over time, though. And house prices notched big increases this spring after declines between the spring of 2022 and early 2023. Shelter costs seem likely to run cool over the next few quarters as a big wave of multifamily construction comes to market, but the recent upside surprises from house prices will have the Fed vigilant about inflationary pressures resurging in the housing market.

After inflation embarrassed the Fed by getting out of control in 2021 and 2022, and the economy grew faster than expected in the first half of 2023, there is a good chance that the Fed’s rate-setting committee raises the federal funds rate another quarter percentage point before year-end to lower odds of inflation rebounding in 2024. But the Fed will likely begin gradually reducing interest rates in the first half of 2024 as confidence grows that inflation is coming back under control.

Bill Adams is a senior vice president and chief economist at Comerica; Waran Bhahirethan is a vice president and senior economist at Comerica.