The Producer Price Index for Final Demand rose 0.1% in June following a 0.4% decline in May (-0.3% in the prior release), a little below the consensus forecast for a 0.2% increase. Foods prices fell 0.1% on the month and were down in six of the last seven months. Energy prices rose 0.7% after a 6.8% drop in May.

Core PPI excluding foods, energy, and trade services (retailer and wholesaler margins) rose 0.1% in June, matching the consensus. Within the services basket, transportation and warehousing prices fell 0.9%, trade service prices rose 0.2%, and other service prices rose 0.3%. Core goods other than foods and energy fell 0.2%.

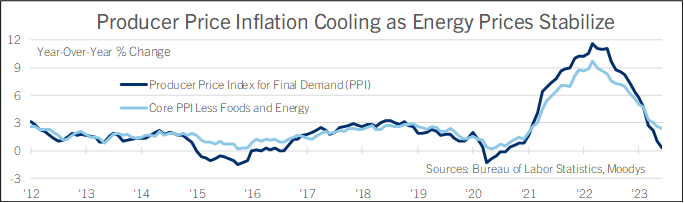

From a year earlier, the PPI edged up a tiny 0.1% in June, below the consensus forecast for a 0.4% increase and following a downwardly-revised 0.9% increase in May (1.1% previously). Core PPI slowed less, to 2.6% in year-ago terms from an unrevised 2.8% in May.

In a separate data release, initial jobless claims fell to 237,000 in the holiday-shortened week ended July 8 from 249,000 in the prior week, which was revised a hair from 248,000 in the last release.

Continued jobless claims in the week ended July 1 rose 11,000 to 1,729,000 from a downwardly-revised 1,718,000 (1,720,000 previously).

The Fed’s June Beige Book—their gold-standard survey of contacts across the economy—reported modest economic growth in June after growth stalled in April and early May. The June Beige Book reads, “economic activity increased slightly,” while the May one said it “was little changed overall in April and early May.”

The last six months have seen a big slowdown in total inflation while core inflation held high. Much of the recent slowdown in total CPI and PPI inflation reflects favorable base comparisons against a period in mid-2022 when prices were surging. As those base comparisons change, total CPI and PPI inflation will likely be roughly flat to slightly higher in year-over-year terms over the next six months.

More importantly, the next six months will likely see slower core inflation. Lower prices of cars and other durable goods are a big disinflationary force on the core basket; consumer spending on big-ticket durable goods is slowing more than spending on services, since it is affected by higher interest rates and since consumers are generally spending more on experiences (travel, Taylor Swift tickets) than things (electronics, appliances).

Furthermore, the drop in house price indices over the last year will bring inflation of average shelter costs down dramatically. There is a huge wave of new rental properties under construction that will come to market in the next year, which will keep rent increases low in 2024.

In a similar vein, wage growth has slowed less than total inflation over the last six months, but is set to moderate further in the second half of 2023. Average hourly earnings rose 4.4% from a year earlier in the June jobs report, a solid notch faster than the 3% increase averaged in the two years before the pandemic. The Fed’s June Beige Book reports wages are slowing more than do the BLS’s data, writing, “Contacts in multiple Districts reported that wage increases were returning to or nearing pre-pandemic levels.”

Other labor market indicators likewise point to less tightness and less upward pressure on wages over the last few months. Initial jobless claims have ranged between 225,000 and 265,000 since March, up from a range of about 180,000 to 220,000 in the prior six months. Continued claims have ranged from roughly 1.72 million to 1.86 million since March, up from a range of 1.29 million to 1.78 million in the prior six months.

LinkedIn’s latest Workforce Report showed another decline in hiring in June, down 2% on the month and 21% on the year, among its U.S. user base which skews more toward professional and clerical occupations than the overall workforce.

The job market is still very strong, as demonstrated by small businesses’ struggle to fill job postings, but not as tight as in 2022.

On net, less inflation plus signs that core inflation and wages will slow near-term suggest the Fed’s expected hike at the end of this month will probably be the last of the cycle. Things could still go wrong if another shock—Russia, Ukraine, China, Taiwan, drought or high temperatures raising food prices, or some other domestic shock—exerts new upward pressure on inflation. But with the US economy slowing and a modest margin of slack opening in its productive capacity, that seems less of a risk than it did up until now.

Bill Adams is a senior vice president and chief economist at Comerica. Waran Bhahirethan is a vice president and senior economist at Comerica.