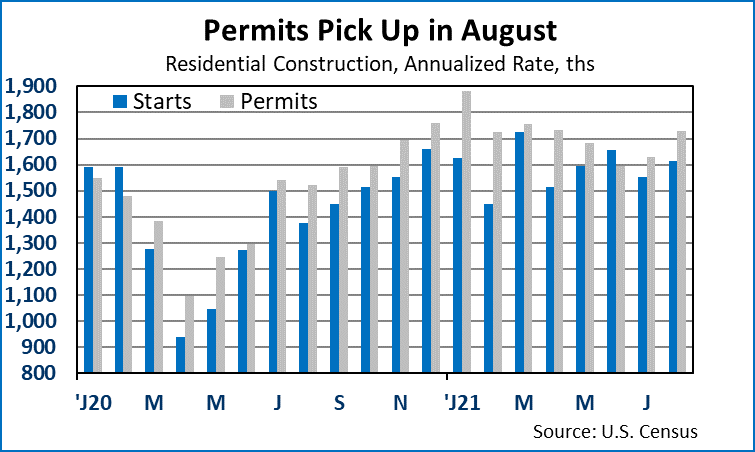

• Housing Starts increased by 3.9 percent in August to a 1,615,000 unit annual rate.

• Housing Permits increased by 6.0 percent in August to a 1,728,000 unit annual rate.

Total U.S. housing starts increased by 3.9 percent in August as multifamily starts jumped. Multifamily housing starts increased by 20.6 percent for the month, to a 539,000 unit annual rate. This is the strongest rate for multifamily starts since January 2020. The series is always volatile but it is beginning to look like we have an uptrend in multifamily construction that began last spring. The series is still rangebound since early 2015. Strong demand and rent gains are motivating builders to add units.

On August 21, the Supreme Court blocked enforcement of the CDC’s federal eviction moratorium. However, there is legislation pending in the Senate that could potentially revive the federal moratorium. Even without a federal eviction moratorium, state and local laws may still offer protection to renters who fall behind on payments.

Single-family starts fell by 2.8 percent in August, to a 1,076,000 unit annual rate, still rangebound since late-2020.

Total permits for new construction increased by 6.0 percent in August, to a 1,728,000 unit rate as multifamily permits climbed. Permits for single-family construction were little changed for the month, up slightly by 0.6 percent, to a 1,054,000 unit rate. Permits for multifamily construction increased by 15.8 percent in August, to a 674,000 unit annual rate.

Surging prices for single-family homes are pushing demand back to rental properties. The uncertainty around evictions moratoria may still be a limiting factor for some new multifamily projects. However, as conditions normalize in the rental market, we expect multifamily construction to increase.

Market Reaction: Stock indexes opened with gains. The yield on 10-year Treasury bonds is up to 1.31 percent. NYMEX crude oil is up to $70.56/barrel. Natural gas futures are down to $4.88/mmbtu.

Dr. Robert Dye is senior vice president and chief economist for Comerica. Daniel Sanabria is a senior economist for Comerica.