Nonfarm payroll employment rose 254,000 in September, much better than the 150,000 consensus forecast, while July and August numbers were revised up a net 72,000 jobs, too.

With these upside surprises, payrolls averaged a 186,000 monthly increase in the last three months, much better than their 116,000 average in the prior report. In September, private employment rose 223,000 and public employment 31,000. Within private jobs, there were notable gains in health care, up 72,000, food services and drinking places, up 69,000, social assistance, up 27,000, construction, up 25,000, and retail, up 16,000. Manufacturing fell 7,000, and temp jobs fell 14,000.

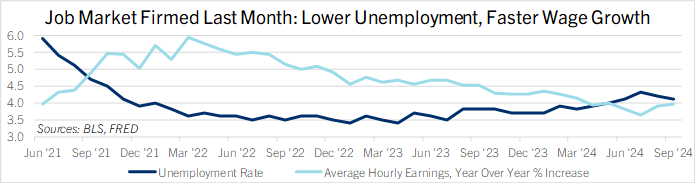

The unemployment rate edged down to 4.1% from 4.2% in August. The BLS does not make monthly revisions to the unemployment rate (Unlike payrolls). The unemployment rate bottomed out in this cycle at 3.4% in the first half of 2023, a half-century low, rose to average 4.2% in July and August, and now has receded a bit.

In the household survey, the labor force rose 150,000 in September, employment rose 430,000, and unemployment fell 281,000. The labor force participation rate was unchanged at 62.7%. The labor force participation rate is up from a year earlier for teenagers and workers aged 25 to 54, but down for workers 20 to 24 and over 55.

In September, the unemployment rate for White Americans fell to 3.6% from 3.8%, for Black or African Americans to 5.7% from 6.1%, for Asian Americans was unchanged at 4.1%, and for Hispanic or Latino Americans fell to 5.1% from 5.5%. The unemployment rate for men aged 20 and older fell to 3.7% from 4.0%, for women to 3.6% from 3.7%, but for teenagers rose to 14.3% from 14.1%. The unemployment rate for workers with a disability was 7.2%, down from 8.3% in August (unlike other unemployment rates, the rate for disabled workers is not adjusted for normal seasonal variations; this rate typically falls August to September).

Average hourly earnings rose 0.4% from August, slightly above the 0.3% consensus. From a year earlier, they rose 4.0%, up from 3.8% in August to the strongest since May. The September CPI report has not yet been released but will likely show the consumer price basket became 2.3% more expensive over the last year, a considerably slower pace of increase than average hourly earnings.

One softer spot in the report was that the average workweek shortened in September to 34.2 hours from 34.3 hours in August. This detail comes from the survey of employers. The workweek shortened in a number of service-providing industries, including private education and health services, professional and business services (which includes temp workers), retail, and trade, transportation and utilities.

Another softer detail is that the unemployment rate again triggered the Sahm Rule in September. This is former Fed economist Claudia Sahm’s observation that when the rate’s three-month moving average rises by a half percent or more from its twelve-month low, the economy has historically been in a recession. September is the third month in a row that the unemployment rate has triggered the Sahm Rule. The July to September period is likely an exception to the Sahm Rule given signs that output and spending are growing solidly, but the Sahm Rule does make clear that the labor force is growing faster than employers are adding jobs.

Even so, the September jobs report considerably brightens the economy’s picture this fall. Incorporating the preliminary benchmark revision announced in mid-August, payroll job growth in the year through September averaged a 169,000 monthly increase, a modest-to-moderate pace.

The Fed will breathe a sigh of relief to see job growth pick up in September after the summer’s slow patch. In the last few months, most jobs data have looked considerably softer than activity indicators like GDP, which has shown the economy experiencing the longest stretch of solid growth since 2006 (real GDP at or above 2.8% in year-over-year terms). The uptick of the unemployment rate and triggering of the Sahm Rule, in particular, show that job creation is lagging short of growth of the workforce. The Fed wants to arrest the trend of rising unemployment and hold the unemployment rate around its current level, one reason they’re cutting rates.

It will get harder for the Fed to judge the state of the economy near term. It has been buffeted by large albeit short-lived shocks in the last few weeks: The devastation of Hurricane Helene, the (now resolved) dock workers’ strike, and the ongoing Boeing strike. Most of the surveys for the September jobs report were conducted before these shocks began to affect the economy, making this one of the last clear reads on the economy this fall.

The Fed is likely to put more weight on the September jobs report at the next rate decision in November than the October report, which could be a noisy one. As such, the September jobs report is likely to persuade Fed policymakers that they have latitude to switch to a smaller rate cut at the next decision after kicking off the rate reduction cycle with a half percent cut in September. Comerica forecasts for the Fed to reduce the Federal Funds rate by a quarter percent at each of the November, December, January, and March decisions.

The biggest risk to this forecast is the intensifying war in the Middle East, which has caused benchmark U.S. oil prices to jump nearly 10% since the start of October. An energy price shock could push up inflation and make the Fed reduce rates less than expected. But even after the latest jump in prices, WTI crude is lower than its 2023 average. If further oil price increases are limited, energy shocks are unlikely to derail the U.S. expansion. The economy is in good shape, with solid growth of jobs and wages, low unemployment, slowing inflation, and falling interest rates. With the Fed likely to continue to reduce rates, the setup for 2025 is favorable, too.

Bill Adams is a senior vice president and chief economist at Comerica. Waran Bhahirethan is a vice president and senior economist at Comerica.