The Consumer Price Index rose 0.3% in June, matching the consensus forecast. Energy rose 0.9% after falling 1.0% in May. The short-lived Israel-Iran War pushed up energy prices temporarily in June, contributing to the month’s increase.

Food prices rose 0.3%, unchanged from May, with food at home up 0.3% and food away from home up 0.4%. In year-over-year terms, CPI inflation accelerated to 2.7% from 2.4% in May.

The core CPI excluding food and energy rose 0.2% on the month, up from 0.1% in May but a little under the 0.3% consensus forecast. New vehicle prices fell 0.3% in June, a second monthly decline. Used car and truck prices fell 0.7%, a fourth monthly decline. Within core services, shelter rose a muted 0.2% on the month, with rent of primary residence up 0.2% and owners’ equivalent rent of primary residence up 0.3%.

Both components held steady in year-over-year terms after rounding, but continue to trend back into the ranges they held before the pandemic. Hospital service charges registered a big 0.7% increase in June, and picked up to 4.2% in year-over-year terms, the fastest since last November.

Airfares edged down 0.1% on the month despite higher energy prices. They’ve fallen for five months running. Ticket prices for movies, theaters, concerts, and sporting events fell 0.2%, down for a third consecutive month. From a year earlier, core CPI picked up to 2.9% from 2.8% and matched the consensus.

The big picture is that the CPI continues to trend a bit above the Fed’s target. In year-over-year terms, the CPI has ranged from 2.3% to 3.0% since June 2024, and core CPI from 2.8% to 3.3%. Both currently sit around the middle of those ranges.

CPI inflation of around two and a quarter percent typically corresponds to inflation of two percent by the PCE price index, which the Fed uses to gauge its performance against its target. While business surveys reported a big pickup in input cost inflation in the second quarter, CPI inflation was still relatively well behaved through June. The Israel-Iran War’s short-lived spike in energy prices pushed up total inflation in the month, but core inflation was little affected.

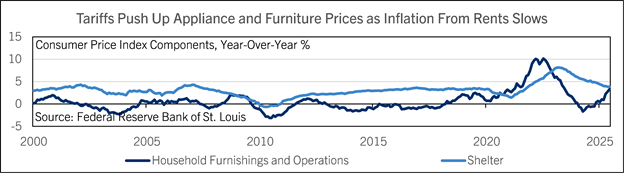

This is not to say that the effects of tariffs are missing entirely from the CPI report. The clearest sign so far is a pickup in home furnishings inflation, the category that includes appliances, kitchenware, linens, furniture, and similar products (See chart below). But the CPI report doesn’t show similar increases for prices of new or used cars, which also have been affected by big tariff increases.

There are several potential explanations. It takes time for businesses to change prices. Businesses may be waiting for clarity on the end-state of tariffs before reacting to them. And, skittish consumer demand could be limiting businesses’ pricing power, and forcing businesses to absorb tarifflation for the time being. The last few months’ drops in new and used car prices, airfares, and event ticket prices point to weak discretionary consumer demand.

It will take time to tease out which of these factors has the largest effect on inflation. At the same time, disconnected from tariffs, the cooling housing market is lowering inflation of shelter costs, which comprise a big chunk of the consumer price basket (Again see chart).

The unemployment rate edged down to 4.1% in June from 4.2% in April and May, a sign the economy continues to provide jobs for most people who want them. The jobs data will make the Fed feel they have latitude to “wait and see” how the crosswinds affecting inflation play out for at least a couple more months. The Fed will almost certainly hold interest rates steady at their July decision. There’s no smoking gun forcing a rate cut then.

Hiring could be sluggish near term, but the unemployment rate is likely to hold roughly steady. Reduced immigration is squeezing the labor supply, so labor demand would have to weaken considerably to cause a meaningful increase in the unemployment rate. Businesses seem unlikely to ratchet labor demand down that much since a big tax cut will become effective in less than a year.

While tariffs seem likely to contribute to higher goods prices in the second half of 2025, the cooling housing market will offset some of their effect on the CPI. Housing weakened in the second quarter, with sluggish construction and sales, and falling house prices. House prices and rents seem likely to run cool in the second half of 2025, too, which will further slow core inflation.

Shelter inflation was a big contributor to the post-pandemic inflation surge and now it’s starting to push in the other direction. Comerica forecasts for the Fed’s next change in interest rates to be a quarter percentage point cut at the December 2025 decision.

Bill Adams is a senior vice president and chief economist at Comerica Bank. Waran Bhahirethan is a vice president and senior economist at Comerica Bank.