• The Producer Price Index for Final Demand increased by 0.2 percent in December.

• Initial Claims for Unemployment Insurance increased by 23,000 for the week ending Jan. 8 to 230,000.

The Producer Price Index for Final Demand increased by a moderate 0.2 percent in December, the weakest monthly increase in 2021.

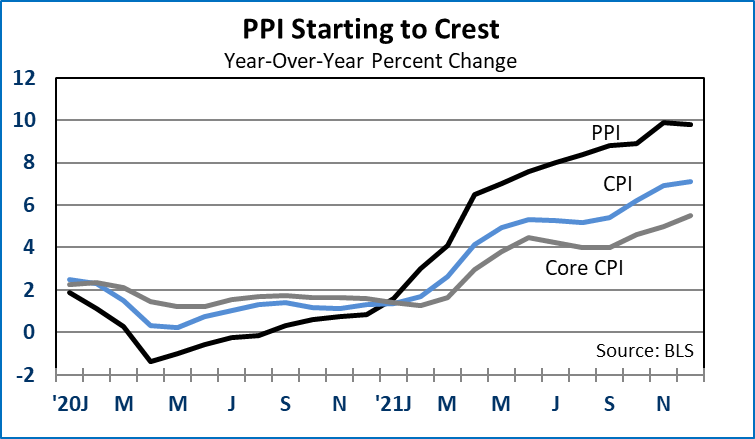

For the year ending in December, headline PPI was up a hefty 9.7 percent. Lower gasoline prices were a major lever in December as the producer energy price index declined by 3.3 percent. That will likely not repeat in January. Wholesale food prices also eased in December, down 0.6 percent for the month.

Excluding food, energy and trade margins, core PPI was up by 0.4 percent in December, above the low mark for 2021 of 0.3 percent monthly growth, set in September and October. For the year ending in December, core PPI was up 6.9 percent. We continue to expect inflation to moderate this year, but it will likely not be a smooth or quick transition to the Fed’s near-2-percent target.

It looks like supply chain strain is starting to ease for some products and some industries, but certainly not for all products and all industries quickly. This is still a transitional economy buffeted by powerful forces in both positive and negative directions.

Lael Brainard was set to testify Thursday morning before the Senate Banking Committee as part of her confirmation hearing for Vice-Chair of the Federal Open Market Committee. She is expected to say that the Federal Reserve is committed to fighting inflation.

Initial claims for unemployment insurance increased by 23,000 for the week ending January 8, to hit 230,000. The minor uptick appears to be inconsequential. Continuing claims fell by 194,000 for the week ending January 1, to hit 1,559,000.

Market Reaction: U.S. equity prices eased after opening gains. The yield on 10-Year Treasury bonds dipped to 1.73 percent. NYMEX crude oil is down to $82.13/barrel. Natural gas futures are down to $4.05/mmbtu.

Dr. Robert Dye is senior vice president and chief economist at Comerica.