Construction spending fell 1.1% in June, well below market expectations for a 0.2% increase. May construction spending was revised up to a 0.1% increase from a 0.1% contraction. Public construction fell -0.5% in June, while private construction fell -1.3%, led by a 1.3% decline in private residential construction with single family down 3.1% and multifamily up 0.4%. Power and commercial construction also saw notable declines of 1.8% and 0.6%, respectively. The fall in public construction was led by highway and street spending, down -2.7% and education construction, down -0.7%. The interest sensitive construction sector is likely to be a drag on economic activity in the second half of 2022 as interest rates remain elevated.

Job openings fell by 605,000 to 10.698 million in June and are over a million below the record of 11.9 million reached in March. The wholesale and retail trade sectors accounted for roughly 70 percent of June’s monthly decline, with retail down 343,000 and wholesale down 72,000. Chair Powell has referenced record high job openings as a sign of the imbalance between labor demand and supply. Fed officials are likely to view June’s fall in job openings as progress toward putting the economy on an even keel.

The ISM manufacturing purchasing managers index (PMI) dipped to 52.8 in July from 53.0 in June, near the 52.9 consensus forecast, and was the lowest since June 2020. The production index eased to 53.5 in July from 54.9 in June. The new orders index was contractionary for a second consecutive month and the employment index contractionary for a third consecutive month. The prices index fell to 60.0 in July from 78.5 in June as commodity prices partially reversed June’s surge.

The ISM services PMI rose to 56.7 from 55.3 and was considerably better than the 53.7 consensus, though still well below the 2021 average of 62.5. Both business activity and new orders rose on the month. Employment remained in contractionary territory for a second consecutive month. Inflation slowed, as in the manufacturing PMI.

The other key service sector PMI for the U.S., released by S&P Global, fell to 47.3 in July from 52.7 in June. With the trend largely lower in PMI and other business surveys, and jobs data softening, the economy is clearly cooling and the odds of a recession over the next year and a half continue to rise.

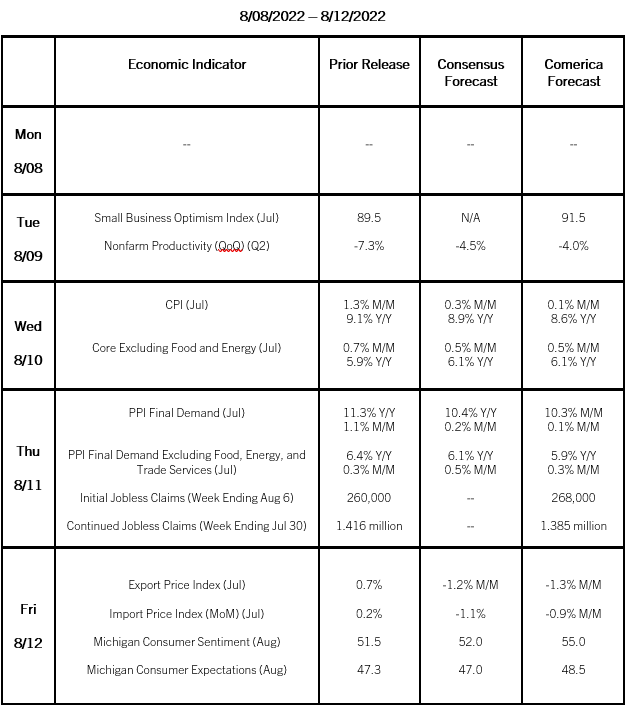

Preview of the Week Ahead

The most important economic release next week will be the July CPI report on August 10; with gas prices down sharply on the month, total CPI is certain to slow after surging in June. Core inflation will be more important for financial markets as a reflection of the trend in inflation. Surveys of small business sentiment on Tuesday and of consumer sentiment on Friday will also be closely read for signs of whether the economy continues to lose momentum.

Bill Adams is senior vice president and chief economist at Comerica. Waran Bhahirethan is vice president and senior economist at Comerica.