The Consumer Price Index for All Urban Consumers or CPI rose 1.2% in March from February on an 18.3% monthly surge in gasoline prices, a knock-on effect of Russia’s invasion of Ukraine. March saw the highest monthly inflation since September 2005, when Hurricane Katrina interrupted U.S. oil supplies. In year-over-year terms, the CPI accelerated to an 8.5% increase from February’s 7.9% and hit a new 40-year high.

The core CPI index—the CPI excluding food and energy—cooled to a 0.3% increase in March from 0.5% in February, and saw the slowest monthly rise since last September. In year-over-year terms, core CPI was unchanged at 6.4%, the highest since 1982. The major factor behind slower monthly core inflation is a 3.8% drop in prices of used cars and trucks. They skyrocketed 57% between mid-2020 and early 2022, and are starting to come back to earth. The prices of used cars and other durable goods will likely rise much more slowly going forward as retail inventories rise and the effect of fiscal stimulus fades.

• The CPI index rose 1.2% in March, the largest monthly increase since 2005.

• An 18.3% surge in gasoline prices accounted for over half of the CPI’s monthly increase.

• Core CPI slowed to 0.3% from 0.5% as used car prices fell 3.8%.

• The drivers of inflation are changing, but price increases will continue to run historically high near-term.

• The Fed will raise the federal funds target by half a percentage point at their May decision.

But inflation in other “core” goods and services will stay very high. This is especially true of housing prices, which have surged since the start of the pandemic, and (unlike used car prices) continue to shoot higher. The CPI measures housing prices indirectly, by including rents paid on primary residences, and also “owners’ equivalent rent (OER) of primary residence”—measured by surveying homeowners on what their homes would rent for. Housing components account for about a third of the CPI index; they are stickier than most other prices; they had the fastest annual increases in 20 years in March; and they are accelerating. Housing costs will keep core inflation high in the second quarter of 2022 and likely into 2023 even as durable goods prices rise much slower.

Food prices are headed higher too. They jumped before Russia-Ukraine due to supply chain disruptions and a shortage of farmworkers, then rose even more after the war’s outbreak. Russia and Ukraine accounted for about a quarter of globally-traded wheat before the war; and interruptions to petroleum supply raise the price of fertilizer (a petroleum product) and shipping. Food price inflation was 1.0% in March and 12.2% annualized in the first quarter; it will stay very high in the second quarter as the commodity shock ripples through the economy.

The story from the March Producer Price Index (PPI) report was similar. The PPI’s monthly increase of 1.4% and its year-over-year increase of 11.2% were both the highest since comparable data started in 2010. Energy prices rose 5.7%, and were responsible for a quarter of the PPI’s monthly increase. This followed a 7.5% increase in energy prices in February. Foods prices jumped 2.4%, a second monthly increase of more than 2%. And trade services prices, which track the margins of retailers and wholesalers, rose 1.2%, a fifth consecutive increase of more than 1%— meaning an 18% annualized rate of increase over the last five months.

Core PPI (excluding food, energy, and trade services) rose 0.9% in March, the largest increase since January 2021. Much of the core index’s increase is due to a 5.5% surge in transportation and warehousing costs. Shipping companies are passing on higher fuel prices to customers.

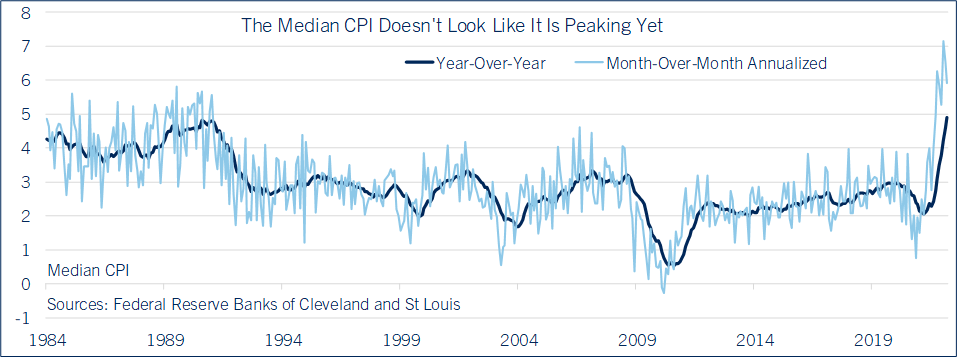

CPI inflation will likely average 0.7% in the second quarter of 2022, or 8% in year-over-year terms. This means total CPI will probably come down slightly from March’s 40-year high. But consumers are unlikely to feel much happier while higher commodity prices are rippling through the economy, forcing businesses that sell unrelated goods or services to raise prices and pass on their own cost increases. One way of quantifying this effect is the median CPI, an alternative measure of the CPI basket where half of consumer prices rise faster and the other half slower. Median CPI accelerated sharply in the first quarter of 2022 and looks set to continue to rise in year-ago terms in the second quarter (See Chart).

The March CPI and PPI reports were the last before the Fed’s next meeting on May 3 and 4, and provide additional support for the Fed to raise interest rates by half a percentage point at both the May decision and the following one on June 15. The Fed also will begin reducing the size of their balance sheet at the May meeting. The Fed’s balance sheet surged from just over $4 trillion dollars in January 2020 to nearly $9 trillion in March 2022 as they flooded the economy with credit to cushion the blow of the pandemic. The Fed is starting to reverse that process, and will likely reduce the balance sheet by over $600 billion by the end of this year.

Bill Adams is senior vice president and chief economist at Comerica.